When Do Mn Property Tax Refunds Come 2024

When Do Mn Property Tax Refunds Come 2024. At least that’s the idea behind hf4826, a bill sponsored by rep. • the net property tax on your homestead increased by more than 12 percent from 2023 to 2024, and • the increase was at least $100, not due to improvements on the property.

But getting ready for next year’s filing period is what the 2024 house tax bill is all about: Vital information for property tax lawyers!

Apr 2, 2024 Updated Apr 2, 2024.

A terrific faculty updates you on property tax appeals in 2024, including:

Additionally, Claims For 2022 Refunds Can Be Filed Until August 15, 2024.

Many taxpayers file their property tax returns at the same time as their income tax returns.

Last Day For Owners To Apply For Class 1C Or 4C (5) Resort Classification.

Images References :

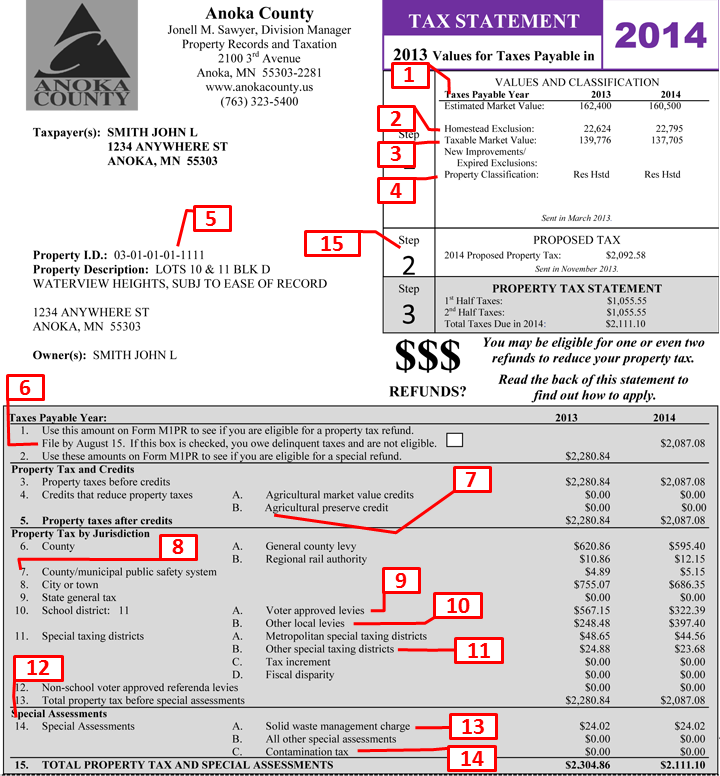

About Your Property Tax Statement Anoka County, MN Official Website, Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Fall’s property tax refunds could become part of spring income tax refunds.

Source: www.taxuni.com

Source: www.taxuni.com

How to Check Minnesota Property Tax Refund Status?, Property tax refunds mail station 0020 600 n. Please wait at least 72 hours before checking the status of your refund on.

Source: u-ukumdesigns.blogspot.com

Source: u-ukumdesigns.blogspot.com

When Are Minnesota Property Tax Refunds Sent Out uukumdesigns, The local ryan experts have. Use our where’s my refund?

Source: www.dochub.com

Source: www.dochub.com

M1pr form 2022 Fill out & sign online DocHub, Moorhead — the minnesota property tax refund and renters refund programs are now open, and officials are reminding the public to file for their 2022. For income and property tax.

Source: printableformsfree.com

Source: printableformsfree.com

Minnesota State Tax Form 2023 Printable Forms Free Online, Individual.incometax@state.mn.us 2023 state filing deadline: The department of revenue estimates that the change would result in a reduction to the general fund of $60.9 million for fiscal year 2024 and $66.3 million for.

Source: form-tax-m1.pdffiller.com

Source: form-tax-m1.pdffiller.com

2023 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller, Call our automated phone system (available 24/7). You lived in your home on january 2, of 2023 and january 2, 2024;

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Where Do I Send My Mn Property Tax Refund PRORFETY, That permanent change would be effective for property taxes payable in 2024, but the bill would beef up the refund program even more on a onetime basis: At least that’s the idea behind hf4826, a bill sponsored by rep.

Source: www.signnow.com

Source: www.signnow.com

Minnesota Property Tax Refund 20192024 Form Fill Out and Sign Printable PDF Template, Last day for owners to apply for class 1c or 4c (5) resort classification. Moorhead — the minnesota property tax refund and renters refund programs are now open, and officials are reminding the public to file for their 2022.

Source: www.dochub.com

Source: www.dochub.com

M1pr form 2022 Fill out & sign online DocHub, However, that time frame can be shortened to. The checks will be mailed out.

Source: www.anokacounty.org

Source: www.anokacounty.org

About Your Property Tax Statement Property Records & Taxation Anoka County, MN, Last day for owners to apply for class 1c or 4c (5) resort classification. But getting ready for next year’s filing period is what the 2024 house tax bill is all about:

If You Are Waiting For A Refund And Want To Know Its Status:

The department of revenue estimates that the change would result in a reduction to the general fund of $60.9 million for fiscal year 2024 and $66.3 million for.

Renters Who Already Filed Have Started Receiving Their Refunds While Homeowners Can.

The irs typically tells taxpayers it will take 21 days to receive their refund after filing.